Royal Dutch Shell plc today announces the signing of two agreements by Shell Canada Energy, Shell Canada Limited and Shell Canada Resources (“Shell”)— which are detailed in this announcement — that will see Shell sell all of its in-situ and undeveloped oil sands interests in Canada and reduce its share in the Athabasca Oil Sands Project (AOSP) from 60 percent to 10 percent. Shell will ...

Royal Dutch Shell plc today announces the completion of two previously announced agreements by Shell Canada Energy, Shell Canada Limited and Shell Canada Resources (“Shell”) that will see Shell sell all its in-situ and undeveloped oil sands interests in Canada and reduce its share in the Athabasca Oil Sands Project (AOSP) from 60% to 10%.

Get Price

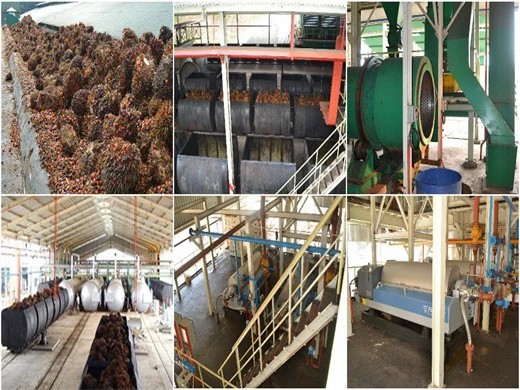

For over 40 years, Fluor has provided feasibility studies, engineering, construction and commissioning for oil sands projects. Our experience includes greenfield and upgrade projects involving oil sands mining, crushing, material handling, slurry pumping, hydrotransport and bitumen extraction.

Get Price

Fluor performed engineering, procurement, construction, and maintenance services for the Muskeg River oil sands mine constructed as part of the Athabasca Oil Sands project. The project was designed to produce 155,000 barrels per day of bitumen. Production began in late 2002 and will continue for approximately 30 years.

Get Price

The Leismer facility in Alberta, Canada. (Photo: Lawrence Sauter) Statoil and Athabasca Oil Corporation (TSX: ATH) have completed their previously announced transaction, whereby Statoil has sold its entire oil sands operations in the Canadian province of Alberta to Athabasca. The divestment includes the producing Leismer demonstration plant and the undeveloped Corner project, along with a ...

Get Price

Mar. 09, 2017 . Royal Dutch Shell plc today announces the signing of two agreements by Shell Canada Energy, Shell Canada Limited and Shell Canada Resources (“Shell”) — which are detailed in this announcement — that will see Shell sell all of its in-situ and undeveloped oil sands interests in Canada and reduce its share in the Athabasca Oil Sands Project (AOSP) from 60 percent to 10 ...

Get Price

These sources do not use Athabasca oil sands and Canadian oil sands interchangeably, and concentrating this article mainly on the Athabasca oil sands is misleading - as is using statistics to represent the Athabasca region that in actuality describe the total area of the Canadian oil sands. As peak oil debates rage and with citations of Canada ...

Get Price

Big players exit Canada’s oil sands April 25th 2017 | Canada | Oil and gas. Canada's oil sands region in the western province of Alberta contains the world's third largest reserves of crude oil, but is also one that is expensive to develop. Some foreign energy firms have been exiting the region as part of their effort to reduce costs in a ...

Get Price

The Athabasca oil sands are large deposits of bitumen or extremely heavy crude oil, located in northeastern Alberta, Canada – roughly centred on the boomtown of Fort McMurray. These oil sands, hosted primarily in the McMurray Formation, consist of a mixture of crude bitumen (a

Get Price

Quest Carbon Capture and Storage Project: Start-up 2015; designed to capture and store over 1 million tonnes of CO 2 each year. Current developments. On March 9, 2017, Shell announced it would sell all of its in-situ and undeveloped oil sands interests in Canada and reduce its share in the Athabasca Oil Sands Project (AOSP) from 60% to 10%

Get Price

Athabasca Oil Corp. is suspending operations at its Hangingstone SAGD oilsands project and cutting staff due to the drop in oil prices and the COVID-19 pandemic. (Athabasca Oil ) Athabasca Oil

Get Price

2017-10-18· Size is crucial in the oil sands; the more bitumen a company can squeeze out of a plant, the lower fixed costs per barrel will be. “(Athabasca) was a company built when oil

Get Price

The Athabasca oil sands, also known as the Athabasca tar sands, are large deposits of bitumen or extremely heavy crude oil, located in northeastern Alberta, Canada roughly centred on the boomtown of Fort McMurray.These oil sands, hosted primarily in the McMurray Formation, consist of a mixture of crude bitumen (a semi-solid rock-like form of crude oil), silica sand, clay minerals, and water.

Get Price

2020-03-20· Athabasca Oil Corporation is a differentiated Canadian energy company focused on sustainable resource development of thermal and light oil assets. We offer investors excellent exposure to oil prices and are focused on maximizing profitability through prudent capital activity across a diversified asset base.

Get Price

The Athabasca Oil Sands Project is the latest fully integrated oil sands development in 25 years. Completed in early 2003, it now supplies over 10% of Canada’s oil needs. The project consists of two main components: The Muskeg River Mine, located 75km north of Fort McMurray, Alberta

Get Price

The data provided gives an overview of the costs, revenues and royalties paid for each oil sands project in Alberta for 2025. The information published here is royalty project data, and is only relevant to and arises from royalty calculations. The information is solely intended for the purpose of

Get Price

Once the deal is complete Statoil will no longer operate any oil sands assets, but will still be a partner in five offshore oilfields in the Atlantic Canada region Athabasca Oil Corp downgraded to

Get Price

Get access to our complete database of historical oil and gas prices, energy statistics and oil sands production data. LEARN MORE → TOTAL BITUMEN PRODUCTION FROM MINING & IN-SITU thousand bbl/day • data by CAPP & AER. TOTAL OIL SANDS EXPENDITURES BY TYPE 4 billion dollars • data by CAPP. TOTAL OIL SANDS EXPENDITURES BY FACILITY billion dollars • data by

Get Price

2017-09-06· The Syncrude Canada mining and upgrading project, of which Suncor is the largest stakeholder, and Canadian Natural’s Athabasca Oil Sands Project, which

Get Price

Shell Canada Ltd. awarded Fluor the engineering, procurement, and construction of the Primary Process Units (PPU) of its Athabasca Oil Sands Downstream Project, located in Fort Saskatchewan, Alberta. This facility has a design capacity of 155,000 barrels of dry bitumen per calendar day. It also includes a crude vacuum unit and an 80,000 BPSD

Get Price

Athabasca Oil Corp develops oil sands in Alberta, Canada. The Company has working interests in the Athabasca region of northern Alberta. The Company has working interests in the Athabasca region

Get Price

CERI therefore concludes that no greenfield oil sands project is economically feasible under the current pricing environment. However, the author concedes the same could be said for any new oil development around the world, and profitability will improve considerably when (not if) oil prices eventually recover.

Get Price

2020-04-03· CALGARY Athabasca Oil Corp. is suspending operations at its Hangingstone SAGD oilsands operation due to the drop in oil prices and the COVID-19

Get Price

Shell is the operator and 60 per cent owner of the Athabasca Oil Sand Project (AOSP), a joint venture between Shell, Chevron Canada Corporation (20 per cent) and Marathon Oil Sands LP (20 per cent). The AOSP consists of the Muskeg River and Jackpine mines, the Scotford Upgrader and the Quest Carbon Capture and Storage (CCS) project (Quest).

Get Price

2020-04-03· Athabasca Oil Corp. is suspending operations at its Hangingstone SAGD oilsands operation due to the drop in oil prices and the COVID-19 pandemic.

Get Price

2020-04-03· By Michael Bellusci Apr 3, 2020 (Bloomberg) Athabasca Oil Corp. fully suspended its Hangingstone oil sands operation to combat low oil prices and uncertainty surrounding coronavirus.The move comes shortly after Athabasca said in March it would curtail production at Hangingstone by about 50% to maximize corporate funds flow and liquidity.

Get Price

4 Lower Athabasca Region Tailings Management Framework for the Mineable Athabasca Oil Sands the Lower Athabasca Region is an economic driver for Alberta and Canada and is expected to continue to increase in the coming years. As industrial development grows, the cumulative effects on the environment may also increase.

Get Price

The Athabasca Oil Sands represent a form of oil deposit significantly more expensive to collect and refine than traditional oil deposits, with operators of extraction facilities being much more vulnerable to fluctuations in the oil price than those at traditional oil fields with lower costs for startup and continued operation. However, advances

Get Price

The Company owns and operates substantial world class oil sands mining assets. The Horizon Oil Sands and the Athabasca Oil Sands Project (AOSP) are approximately located 70 km north of Fort McMurray, Alberta in the Athabasca region. These assets offer decades of no decline synthetic crude oil (SCO) production with no reserve risk. Canadian

Get Price

Background. The Athabasca Oil Sands Project in Alberto, Canada was a joint venture of Shell, Chevron Texaco, and Western Oil Sands. At the time, it was one of the largest construction projects on the planet, and the latest fully integrated oil sands development in 25 years.

Get Price

2025-04-11· As a result of these issues, oil from the oil sands has a higher environmental cost than other sources, Belanger says. “I grew up in the bush up there,” he says. “Alberta is incredibly

Get Price

The Geology of the Oil Sands. Many years of scientific study were required in order to develop an understanding of the nature, extent and origin of Alberta’s oil sands. Initially, government was the primary sponsor of this research, but as time passed industry also became involved in unlocking the secrets of the oil sands.

Get Price

2016-12-15· Statoil sells northern Alberta oilsands assets to Athabasca Oil for $832M. The surprise deal includes the Leismer thermal oilsands project and Statoil's proposed Corner oilsands project

Get Price

Canada’s oil sands are developed by the private sector, with major investments from companies based in Canada, the United States, Europe and Asia. As a result, the economic benefits of their development reach across Canada and around the globe. An estimated C$217 billion of capital expenditures have been invested in the oil sands industry to date, including $33 billion in 2013.

Get Price

2016-12-14· Athabasca Oil Corporation is a Canadian intermediate sized energy company with a focused strategy on the sustainable development of its asset base which is exclusively located in Alberta. Current operations include the development of the liquids rich Montney and Duvernay resource plays and the ramp-up of its Hangingstone oil sands project which is expected to reach design capacity in 2025.

Get Price

The data provided gives an overview of the costs, revenues and royalties paid for each oil sands project in Alberta for 2025. The information published here is royalty project data, and is only relevant to and arises from royalty calculations. The information is solely intended for the purpose of

Get Price

Future oil prices are a key driver of future oil production and a key uncertainty to the projections in the Canada’s Energy Future 2017: Energy Supply and Demand Projections to 2040 (EF2017). Crude oil prices could be higher or lower depending on demand, technology, geopolitical events, and the pace at which nations enact policies to reduce GHG emissions.

Get Price

Welcome To Athabasca Minerals. Athabasca Minerals Inc. is an integrated group of aggregates companies involved in resource development, aggregates marketing and midstream supply-logistics solutions. Business activities include aggregate production, pit management services, sales from corporate-owned and third-party pits, acquisitions of sand

Get Price

Amounts shown in italicized text are for items listed in currency other than Canadian dollars and are approximate conversions to Canadian dollars based upon Bloomberg's conversion rates.

Get Price