'The worst bear market of our lifetime': A Wall Street investment chief who predicted the recession says stocks may fall 64% before the dust settles — and lays out 3 trades set to profit from the...

The purpose of this paper is to examine the pricing efficiency of the Malaysian crude palm oil(CPO) market before and after the structural break. This study uses the daily closing price of CPO and ...

Get Price

Worldwide crude oil prices will average $43.30 a barrel for 2020 and $55.36/b in 2021. That's according to the Short-term Energy Outlook by the U.S. Energy Information Administration. The price estimate plummeted from last month's prediction of $61/b.

Get Price

Crude oil can be light or heavy. Oil was the first form of energy to be widely traded. Some commodity market speculation is directly related to the stability of certain states, e.g., Iraq, Bahrain, Iran, Venezuela and many others. Most commodities markets are not so tied to the politics of volatile regions.

Get Price

The aim of this paper is to study the long-term relationship between oil prices and economic activity, proxied by GDP. To account for asymmetries existing in the links between the two variables ...

Get Price

We also find that crude oil contributes the least to volatility spillover relative to the other three agricultural markets. This indicates that the US crude oil market is more or less independent from the others. In addition, the net connectedness in the last row of Panel A shows that each commodity contributes differently to the oil ...

Get Price

Prices. EIA delayed the release of the March STEO update by one day to incorporate recent significant global oil market developments. On March 9, Brent crude oil front-month futures prices fell below $35/b, a 24% daily decline and the second largest daily price decline on record.

Get Price

We investigate price and volatility risk originating in linkages between energy and agricultural commodity prices in Germany and study their dynamics over time. We propose an econometric approach to quantify the volatility and correlation risk structure, which has a large impact for investment and hedging strategies of market participants as ...

Get Price

Top Five Factors Affecting Oil Prices In 2015 By Nick Cunningham - Jan 03, 2015, 6:00 PM CST. Join Our Community. As we ring in the New Year, let’s take stock of where we are at with the oil ...

Get Price

Information about the open-access article 'Long-term relationship of crude palm oil commodity pricing under structural break' in DOAJ. DOAJ is an online directory that indexes and provides access to quality open access, peer-reviewed journals.

Get Price

Long-term relationship of crude palm oil commodity pricing under structural break Monsurat Ayojimi Salami and Razali Haron IIUM Institute of Islamic Banking and Finance, Kuala Lumpur, Malaysia

Get Price

The purpose of this paper is to examine the pricing efficiency of the Malaysian crude palm oil (CPO) market before and after the structural break. This study uses the daily closing price of CPO and CPO futures (CPO-F) for the period ranging from June 2009 to August 2016 while taking structural breaks into account. In this study, symmetric and asymmetric long-run relationship model are employed

Get Price

EXAMINING THE LONG TERM RELATIONSHIP BETWEEN CRUDE OIL AND

Get Price

Reuters for the latest commodities news, including updates on oilseeds.

Get Price

Crude Oil Prices 70 Year Historical Chart. Interactive charts of West Texas Intermediate (WTI or NYMEX) crude oil prices per barrel back to 1946. The price of oil shown is adjusted for inflation using the headline CPI and is shown by default on a logarithmic scale. The current month is updated on an hourly basis with today's latest value.

Get Price

Long-term relationship of crude palm oil commodity pricing under structural break Monsurat Ayojimi Salami, Razali Haron. The purpose of this paper is to examine the pricing efficiency of the Malaysian crude palm oil (CPO) market before and after the structural break.

Get Price

This paper reviews the nature of links or relationships between crude, palm oil prices and stocks and its short term implications on the palm oil price trend in 2012. An econometric method is used to empirically forecast the palm oil price movements in the year 2012 using monthly historical data over the period of January 2002 to December 2011.

Get Price

This paper proposes a panel threshold cointegration approach to investigate the relationship between crude oil shocks and stock markets for the OECD and non-OECD panel from January 1995 to December 2009. Nonlinear cointegration is confirmed for the oil-stock nexus in the panel.

Get Price

Crude palm oil average weekly price (USD/ton) No EU anti-dumping duties on biodiesel imports from Malaysia and Indonesia, main producers of Palm Oil 2025 overproduction and lower demand than anticipated of palm oil have resulted in large stocks.

Get Price

Long-term drivers of oil price decline Following on steady declines in other commodity prices, the drop in oil prices in the second half of 2014 was Crude oil production only. Latest observation of U.S. production for November 2014. “Tig count” is U.S. total oil rig amount (EOP). 6.

Get Price

regression and recent econometric analysis were conducted to determine the price relationships of the Malaysian Crude Palm oil prices in the long-term crude palm oil futures market and

Get Price

WTI Crude Oil Prices 10 Year Daily Chart. Interactive chart showing the daily closing price for West Texas Intermediate (NYMEX) Crude Oil over the last 10 years. The prices shown are in U.S. dollars. The current price of WTI crude oil as of March 27, 2020 is $21.51 per barrel.

Get Price

TRADING ECONOMICS provides forecasts for Commodity prices based on its analysts expectations and proprietary global macro models. The current forecasts were last revised on March 31 of 2020. Please consider that while TRADING ECONOMICS forecasts for Commodities are made using our best efforts, they are not investment recommendations.

Get Price

Get the latest Crude Oil price (CL:NMX) as well as the latest futures prices and other commodity market news at Nasdaq. Looking for additional market data No Press Releases are currently

Get Price

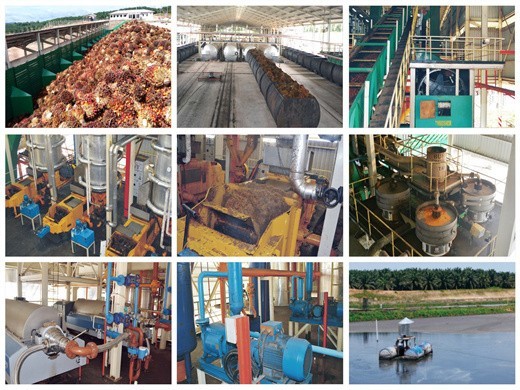

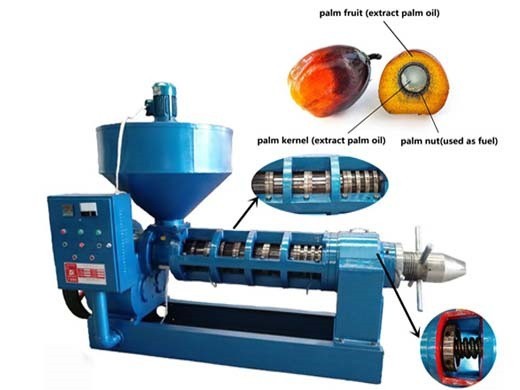

Indonesia’s wet tropical climate provides ideal growing conditions for oil palm. Indonesia is the world’s leading palm oil producer, and is responsible for approximately half the global production of this of commodity. Since 2000, the area of smallholder oil palm cultivation more than tripled, to over a 3.6 million hectares (ha) in 2011.

Get Price